In Money magazine's Make More in 2014, you'll find next year's economic outlook, where to find opportunities in stocks and bonds, the best moves for homebuyers, sellers and owners, and strategies for boosting your career. This installment: How to play the housing market.

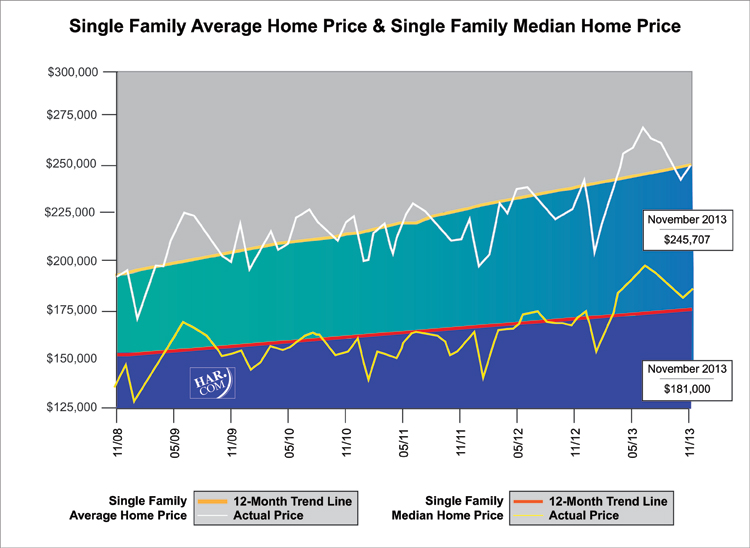

The good news for housing is that price gains next year are expected to be only about half as strong as in 2013, when sellers stayed on the sidelines. Yes, that's good news. "For a sustainable recovery you want to see more balance between buyers and sellers," says David Stiff, chief economist at CoreLogic Case-Shiller, which is forecasting a 6.8% rise in the median home value for 2014."It will still be a sellers' market in 2014, given how far we have before inventory is back to normal," says Jed Kolko, chief economist at Trulia, noting the supply of homes in September was still about 15% below historical norms. "But it will not be as extreme as 2013," he says.

Buyers will also enjoy an advantage next year as real estate investors are expected to be less of a factor. Why? In an improving market, there are fewer distressed homes, which they covet. According to the Campbell/Inside Mortgage Finance HousingPulse Tracking survey, the investor share of residential home purchases fell from 23% earlier this year to 17% in September. In a more balanced market like this, here's what you can do to get an edge:

BUYERS

Waiting for more inventory can make sense if you have a dream home in mind. But in 2014 there will be a price for delay -- 30-year fixed-rate mortgages are forecast to climb from today's 4.5% to more than 5%.

Work with a fast closer. Qualifying for loans is easier now, but speed is another issue. Franklin, Tenn., agent Patty Latham says she will not work with buyers using a particular lender that has missed several deadlines. For speed, Virginia agent Rob Wittman suggests sticking with local lenders with ties to nearby appraisers.

Related: Was my home a good investment?

What's fast? John Wheaton at Guaranteed Rate says, "Where 45 days was the norm, you can get an express closing in 20 days and even faster."

Lead with a credible offer. At a time of multiple bids, low-balling isn't the way to go. "The reality is, sellers don't have to come back to you with a counter if they've got better bids," Wittman says. Of course, you don't want to overpay either. Even in markets that are starting to experience bidding wars, such as L.A. and Boston, final sales prices are still typically about 1% below asking. Use that and your agent's local knowledge and go in with a respectable bid.

OWNERS

If you like your home and are not in a rush to sell, you have great flexibility. For instance, your rising home equity will make it easier to borrow against the property. That can help pay for deferred maintenance or home renovations you've been eyeing for years -- which will only add value when you eventually put your home on the market.

Remodel within reason. Home-improvement spending is expected to grow by double digits through mid-2014, according to Harvard's Joint Center for Housing Studies. Atop the wish list: bathroom and kitchen jobs.

Keep resale in mind. While the focus was on value at the market lows, today "homes with all the fixings are the ones attracting multiple buyers," says McLean, Va., real estate broker Jon Wolford. So, yes, you can splurge a bit, but don't go crazy. Remodeling Magazine's cost-vs.-value survey found that moderate kitchen remodels ($57,500) recouped 69% of their cost, close to what minor jobs paid back. Over-the-top projects ($111,000), though, recouped less than 60%.

Take advantage of low home-equity rates. While 30-year mortgages rose nearly a point this year, rates on home-equity lines of credit have fallen a bit to 5.1%. That's because HELOCs are tied to short-term rates that the Fed isn't likely to hike until 2015.

If you'll need to repay your loan over many years, though, go with a fixed-rate home-equity loan. Today's 6.25% average is about 0.25 points lower than a year ago, as lenders are now more interested in doing deals, says Keith Gumbinger at HSH.com. Credit unions can be the best place to shop for home-equity loans. The average credit union rate is 5.75%.

SELLERS

List too early and you'll leave gains on the table. Wait too long and rising borrowing costs might put an end to bidding wars. You can't time the market perfectly, but you can keep an eye on inventory trends. Ask your agent to give you a monthly report on the number of listings compared with closings. Housing trends play out gradually.

Once you see a big uptick in listings relative to closings, you'll know price gains are getting ready to slow -- and that it's time to act.

Related: New mortgage rules may mean less choice

Price it right the first time. Don't waste your time by listing too high only to have to wait and lower the price. "Buyers are smart these days -- they know where the market is, and now that rates are higher, they aren't going to bite on a list price above recent comparables," says Sara Fischer, an agent with Redfin based in San Diego. The real estate site Zillow reports that about one-third of listed homes in August had a price drop, up from 26% earlier this year.

Play tour guide for the appraiser. If your buyer's lender gets an appraisal that comes in lower than the agreed-upon price, you're in for plenty of headaches -- even in an improving market. You'll have to lower the price, the buyer will have to cough up a bigger down payment, or worst case, the deal might collapse, sending you back to square one.

Fischer recommends that sellers be present when appraisers come by. "They don't want to listen to the agent," she says. "But if you're the owner and can walk them through all the improvements, that can help the appraiser better understand what has gone into the home." She recommends handing the appraiser a spreadsheet of all upgrades, listing when they were done and the scope of each project.

www.jaredanthonycox.com

Home

Home